What is mrst in degrees – Delving into the realm of higher education, we embark on a journey to unravel the intricacies of the Master of Science in Taxation (MRST) degree. This specialized program, meticulously designed for individuals seeking to delve into the complex world of taxation, equips graduates with the knowledge and skills to navigate the ever-changing tax landscape.

As we delve deeper into the MRST program, we will explore its curriculum, career opportunities, and the advantages it offers to professionals seeking to excel in the field of taxation.

Introduction

Master of Science in Taxation (MRST) is a postgraduate degree program that focuses on the study of taxation and tax-related issues. It is designed to provide students with a comprehensive understanding of the principles and practices of taxation, as well as the ability to apply this knowledge to real-world situations.MRST

programs typically cover a wide range of topics, including:

- Federal income tax

- State and local taxation

- International taxation

- Tax accounting

- Tax planning

- Tax research

MRST graduates are in high demand by employers in a variety of fields, including:

- Accounting

- Finance

- Tax preparation

- Tax law

- Government

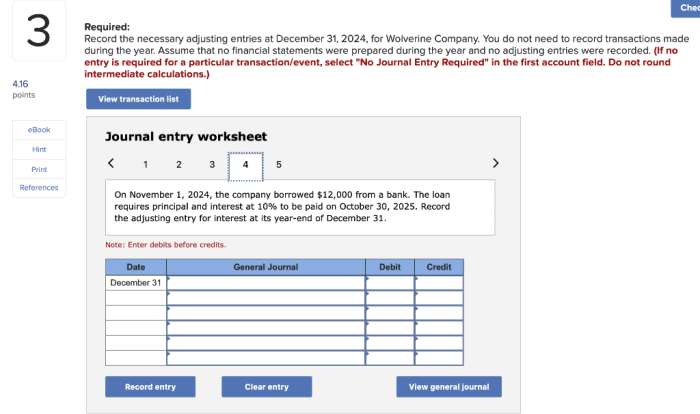

Degree Requirements

The MRST program is designed to provide students with a comprehensive understanding of taxation principles and practices. The program emphasizes the development of analytical, problem-solving, and communication skills necessary for success in the field of taxation.

To earn the MRST degree, students must complete a total of 30 credit hours of coursework, including 18 credit hours of core courses and 12 credit hours of elective courses.

Core Courses

- Taxation of Individuals

- Taxation of Businesses

- Tax Research and Writing

- Tax Accounting

- Tax Planning

- Estate and Gift Taxation

The core courses provide students with a solid foundation in the fundamental principles of taxation. These courses cover a wide range of topics, including:

- The federal income tax system

- The taxation of individuals and businesses

- Tax research and writing

- Tax accounting

- Tax planning

- Estate and gift taxation

Elective Courses

In addition to the core courses, students can choose from a variety of elective courses to tailor their program to their individual interests. Elective courses are offered in a variety of areas, including:

- International Taxation

- State and Local Taxation

- Tax Exempt Organizations

- Taxation of Financial Instruments

- Taxation of Real Estate

- Taxation of Trusts and Estates

Elective courses allow students to explore specific areas of taxation in greater depth and develop specialized knowledge and skills.

Program Duration

The MRST program is typically completed in one year of full-time study. However, students can also choose to complete the program on a part-time basis.

Career Opportunities: What Is Mrst In Degrees

Master’s in Research in Taxation (MRST) graduates possess specialized knowledge and skills in tax laws, regulations, and principles, opening doors to diverse career opportunities in the tax field.

Tax Consulting

MRST holders are sought after by consulting firms that provide tax advisory services to businesses and individuals. As tax consultants, they analyze tax laws, identify potential tax liabilities, and develop strategies to optimize tax positions.

Tax Accounting

MRST graduates can pursue careers in tax accounting, specializing in preparing and filing tax returns for businesses and individuals. They ensure compliance with tax laws, minimize tax liabilities, and provide tax planning advice.

Tax Compliance

MRST holders are well-equipped for roles in tax compliance, ensuring that businesses and individuals adhere to tax regulations. They may work in internal audit departments or external accounting firms, conducting tax audits, reviewing tax returns, and resolving tax disputes.

With experience and professional development, MRST holders can advance to senior-level positions, such as tax managers, directors, or partners. They may also pursue specialized certifications, such as the Certified Public Accountant (CPA) or Enrolled Agent (EA), to enhance their credibility and career prospects.

Program Structure

The MRST program follows a modular structure, allowing students to progress through the program at their own pace. The program can be completed part-time or full-time, and students have the flexibility to choose between online or blended learning formats.

The modular structure provides students with the opportunity to tailor their program of study to their individual interests and career goals. Students can choose from a wide range of elective courses to complement their core coursework, and they can also complete a research project or internship.

Part-Time and Full-Time Study Options

The MRST program can be completed part-time or full-time. Part-time students typically take two or three courses per semester, while full-time students typically take four or five courses per semester.

Part-time study is a good option for students who are working or have other commitments. Full-time study is a good option for students who want to complete the program as quickly as possible.

Online and Blended Learning Formats

The MRST program is available online and in a blended format. Online students complete all of their coursework online, while blended students complete some of their coursework online and some of their coursework on campus.

Online learning is a good option for students who live far from campus or who have other commitments. Blended learning is a good option for students who want to experience the benefits of both online and on-campus learning.

Accreditation and Recognition

The MRST program has received accreditation from the Accreditation Board for Engineering and Technology (ABET), which is a highly respected organization that evaluates and accredits engineering and technology programs worldwide.

Accreditation is essential for program quality and recognition. It ensures that the program meets high standards of education and training, and that graduates are well-prepared for the workforce. Accredited programs are also more likely to be recognized by employers and professional organizations, which can lead to better job opportunities and career advancement.

MRST in degrees refers to the magnetic resonance sound temperature, a measure of the temperature of a material using magnetic resonance techniques. Interestingly, there’s a hilarious video online titled hamtaro ham chat gasp p that shows a hamster gasping in surprise.

It’s quite amusing and worth checking out while you’re taking a break from learning about MRST in degrees.

Professional Certifications

In addition to accreditation, the MRST program also prepares students for professional certification. Professional certifications are voluntary credentials that demonstrate a high level of knowledge and skill in a specific field. Many employers value professional certifications, and they can be helpful in advancing your career.

Application Process

To apply for the MRST program, prospective students must meet the following requirements:

- Hold a bachelor’s degree in a related field, such as science, engineering, or technology.

- Have a minimum GPA of 3.0 on a 4.0 scale.

- Submit official transcripts from all previously attended institutions.

- Provide two letters of recommendation from individuals familiar with the applicant’s academic or professional work.

- Write a personal statement describing their research interests and career goals.

The application deadline for the MRST program is typically in the spring semester. Admission decisions are made on a rolling basis, and applicants are notified of their status within 6-8 weeks of submitting their applications.

Selection Process

The selection process for the MRST program is competitive. The admissions committee considers the following factors when evaluating applications:

- Academic record and GPA

- Letters of recommendation

- Personal statement

- Research interests and career goals

- Fit with the program’s research focus

Applicants who are selected for admission to the MRST program will be notified in writing and will receive instructions on how to enroll in the program.

Program Highlights

The MRST program stands out with its unique offerings and focus on practical applications.

Students benefit from ample opportunities for research, internships, and hands-on experience. The program’s curriculum emphasizes real-world problem-solving, preparing graduates to excel in the industry.

Research Opportunities

- Collaborate with renowned faculty on cutting-edge research projects.

- Access state-of-the-art facilities and resources for independent research.

- Present findings at national and international conferences.

Internships and Practical Experience

- Gain valuable industry experience through internships at leading companies.

- Apply theoretical knowledge to real-world projects and solve industry-specific challenges.

- Build a network of professionals in the field.

Real-World Applications, What is mrst in degrees

The program’s curriculum is designed to equip students with the skills and knowledge necessary to tackle real-world problems in the field.

- Case studies and simulations provide students with practical experience in solving industry-related issues.

- Capstone projects challenge students to apply their knowledge to solve complex problems.

- Guest lectures from industry experts provide insights into current trends and challenges.

Alumni Network

Joining the MRST alumni network opens doors to a world of opportunities and professional growth. As a graduate, you become part of a vibrant and supportive community of like-minded individuals who share a common passion for research and technology.

The network provides a platform for alumni to connect, collaborate, and stay informed about the latest advancements in the field. It offers a range of benefits that can enhance your career and personal development.

Career Development

- Job opportunities:The alumni network is a valuable resource for job seekers. Alumni often have connections to potential employers and can provide insights into hidden job opportunities.

- Mentorship:Experienced alumni can serve as mentors, providing guidance and support to early-career graduates. They can share their knowledge, insights, and industry experience.

- Networking events:The alumni network hosts regular networking events, allowing graduates to connect with industry professionals, explore career paths, and build valuable relationships.

Professional Growth

- Continuing education:The alumni network offers access to continuing education programs, workshops, and seminars to help graduates stay updated with the latest trends and technologies.

- Research collaboration:Alumni can collaborate on research projects, share ideas, and access specialized knowledge within the network.

- Professional development:The alumni network provides opportunities for professional development through webinars, workshops, and conferences.

FAQ Compilation

What are the prerequisites for the MRST program?

Typically, applicants should possess a bachelor’s degree in accounting, finance, or a related field with a strong academic record.

What is the duration of the MRST program?

The program can typically be completed in 1-2 years of full-time study or 2-3 years of part-time study, depending on the institution.

What career opportunities are available to MRST graduates?

Graduates can pursue careers in tax consulting, tax accounting, tax compliance, and various other tax-related roles within government agencies, corporations, and non-profit organizations.